Many people who have flexible spending accounts are unaware that they can use those dollars for their eye care. As the money in these accounts typically expires at the end of the year, it is essential to take advantage of any remaining funds to address your vision needs.

You also save money by reducing your taxes when you use these funds. Keep reading to learn more about how flex spending works towards your eye care needs!

What Is Flex Spending?

A flexible spending account (or FSA) is a special account offered through many workplaces. Employees contribute to their accounts with pretax dollars, meaning they do not pay tax on these funds.

An FSA is like a savings account, except it can only be used towards healthcare-related costs. You can use this money to pay for otherwise out-of-pocket costs. These include copayments, deductibles, and some prescriptions.

The exact terms of a flexible spending account can vary from employer to employer. Some employers make contributions to the account as well. Many workplaces match contributions or contribute a set amount.

The entire balance of your flexible spending account is available to use at any time, but it will expire before the end of the year. You can also use funds for your spouse and any dependents.

How Does an FSA Differ From an HSA?

Flexible spending accounts and health savings accounts (HSAs) can save you money on your medical expenses. This is because they offer tax-advantaged funds. However, there are a couple of key differences between the two.

Unlike an FSA, health savings accounts (HSAs) can roll over from year to year. The money in a flexible spending account, on the other hand, must be used within the year. Any remaining funds are lost at the end of that time (unless your employer provides a grace period).

This is because you own your HSA while your employer controls an FSA. If you leave your job, you can take your HSA with you, while an FSA would have to be forfeited upon employment termination.

In addition, you can contribute more to an HSA. Health savings accounts have higher annual contribution limits than flexible savings accounts.

Using Your FSA for Eye Care

Rather than paying for eye care expenses out of pocket, you can save money by taking advantage of your flexible spending account.

You can use your FSA towards items such as:

- Eye exams

- Glasses

- Prescription sunglasses

- Reading/computer glasses

- Contact lenses

- Contact lens solutions and cases

- Eye drops

- Eyewear accessories

- Certain procedures like LASIK

Non-prescription eyewear and colored contacts are not usually considered eligible. Some plans only cover certain brands of glasses or contacts.

Your provider may give you a card to use when making FSA-eligible purchases. Others require you to submit receipts for reimbursement. If you have any questions about what your FSA can cover, contact your provider directly for more information.

Many people choose to get new glasses or order new contact lenses before the end of the year to prevent their flex spending dollars from expiring. With the year coming to a close shortly, consider using them to pay for your end-of-the-year vision care needs if you have any remaining funds.

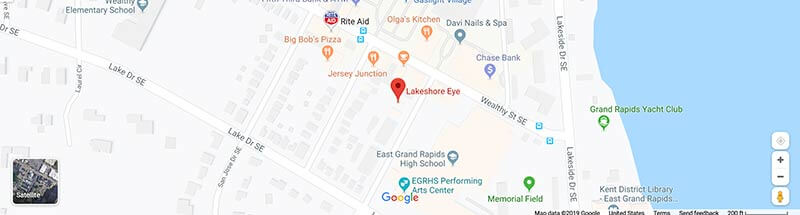

Schedule an Appointment

Schedule an appointment today to experience the GRO difference. Call 616.588.6598 or click here.